Is there a market opportunity for organic products from Africa?

Consumers are willing to pay a better price for better quality. This is only one of many benefits organic farming offers to farmers from developing countries, through export of organic products to premium markets in developed countries. Demand for organic products is growing since more than twenty years and offers a huge income potential for producers, processors and trading companies all over the world. Certified organic products provide access to attractive local and international markets, where higher prices and incomes are possible. As a consequence, organic products from Africa are currently exported to many countries, especially in Europe, and are being successfully exhibited in international trade fairs. Nevertheless, many farmers in Africa still do not have access to the organic export market and domestic markets are still small. Therefore, there is a considerable need to improve market access and develop domestic and export markets.

Demand for organic products

Organic markets have developed fast in the past decades, especially in richer countries. The reasons for this growth include:

- Increased consumer demand for healthy and sustainably produced food, which triggered important investments from the side of retailers to boost the awareness for these products, and

- Enhanced public support for the organic sector, aiming to set in place a regulatory framework that benefits both farmers and consumers and involving subsidies and control mechanisms to ensure consumer protection.

Highest demand for organic products in North America and Europe

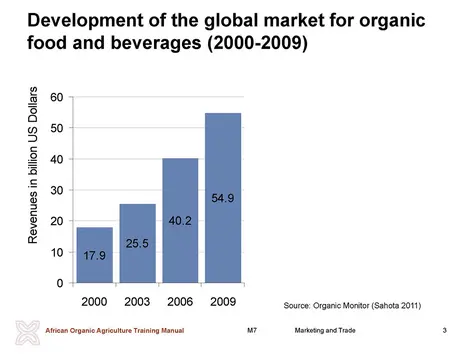

According to Organic Monitor estimates, global organic food and drink sales expanded by roughly five percent to 54.9 billion US dollars in 2009. Global revenues have increased over three-fold from 18 billion US dollars in 2000 and double-digit growth rates were observed each year, except in 2009. In most countries, the market is continuing to grow. Consumer demand for organic products is concentrated in North America and Europe; these two regions comprise 97 percent of global revenues. Asia, Latin America and Australasia are important producers and exporters of organic foods.

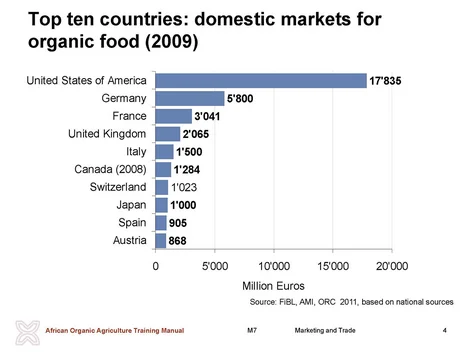

By far the largest organic market is the United States, followed by the European countries of Germany and France. Even though these countries are important organic producers themselves, there are major opportunities for exporting countries – particularly for crops that cannot be grown in the countries as well as off-season products.

The support for organic agriculture is particularly high in Europe and North America where consumers are well informed about organic agriculture and the benefits of organic products. Therefore, North America, the European Union, Switzerland and Japan are the largest markets for organic products; their respective regulations play an important role not only in these countries themselves but also in the exporting countries.

1 US dollar = 0.71895 Euros; average exchange rate 2009, Source: http://www.oanda.com/lang/de/currency/average

2 FiBL and IFOAM (2011): The World of Organic Agriculture 2011. Statistics and Emerging Trends. Edited by Helga Willer and Lukas Kilcher: International Federation of Organic Agriculture (IFOAM), Bonn, and Research Institute of Organic Agriculture (FiBL), Frick

Opportunity A – Export Market

The fast-growing world market for organic produce offers increasing trade opportunities for African organic farmers. In fact, the majority of certified organic produce from Africa is destined for export markets, with the large majority being exported to the European Union, which is Africa’s largest market for agricultural produce.

For instance, the total value for the export of organic produce from Uganda has been estimated at 37 million US dollars in 2009. In most cases, due to the dominance of small-holders in Africa, the typical supply chain is made up of a private enterprise organising many small-holders as outgrowers to secure the sufficient quantities for export, or farmers are working together on one project supplying and packaging for exporting trading companies.

In Tanzania, for example, the total value for the nine most exported organic product categories was estimated at almost 10 million Euros in 2009. The exports are mostly destined for the European Union and the USA. In terms of tons, heavier nut products like cocoa, cashews and coffee are on the top. In economic terms, cocoa, cashews, vanilla and tea are the most important export products. They represent 55 percent of the total organic export value.

The driving factor for the organic export business lies in the growing interest of big retailers and processing companies to broaden the portfolio of organic products. Consumers should not only be able to buy fresh organic products, but also different types of convenience food, ranging from frozen organic pizza to ready to eat breakfast cereal mixes (see picture below). Since the fast growth of such processed food implies the purchase of a broad range of organic ingredients, countries have started to specialize on specific ingredients including: medicinal herbs and spices, dried fruits and mushrooms, flavours and sweeteners.

3 US Dollar = 0.71895 Euros; average exchange rate 2009. Source: www.oanda.com

4 Bouagnimbeck, Hervé: Organic Farming in Africa. In FiBL and IFOAM (2010): The World of Organic Agriculture 2010. Statistics and Emerging Trends. Edited by Helga Willer and Lukas Kilcher: International Federation of Organic Agriculture (IFOAM), Bonn, and Research Institute of Organic Agriculture (FiBL), Frick

Brainstorming session: export markets for organic products from Africa

Engage the participants in a discussion about export markets for organic products. Let them elaborate and share ideas based on the following questions:

- Why is the large majority of African organic product being exported?

- What could be done to further promote exports?

Opportunity B – Domestic Market

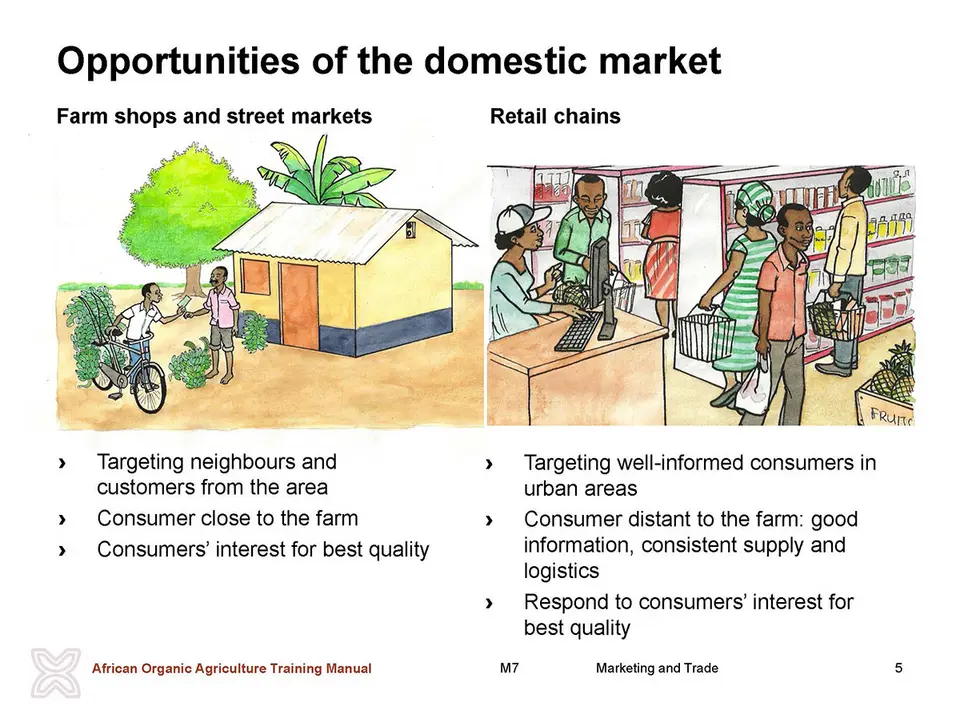

Although the African market for organic products is still small, domestic organic markets are growing in Africa. Local organic markets are usually located near capital cities and major towns. The majority of the consumers that know and care for organic are foreigners and upper-middle class citizens with values similar to European organic consumers. The products marketed include organic fresh fruit and vegetables, dairy products, meat, wine, herbs and personal care products. In Tunisia and in Egypt, specialized shops and a number of supermarket chains (Metro and Carrefour) have organic sections. Similarly, organic shops in South Africa, Kenya and Uganda and Ghana are also picking up organic products and, therefore, playing a growing role in the domestic organic market. In Zambia, organic farmers sell their produce in local farmers’ markets or to urban supermarkets. There is no doubt that, with increasing awareness, the potential of local or domestic African markets for organic products will increase. However, few African countries have articulated a concrete promotion strategy for domestic markets.

In Uganda, organic products for the domestic market are sold via a number of outlets including supermarkets, restaurants, international schools and open markets. There is a big range of organic products supplied by small-scale farmers and processors on the domestic market. These include coffee, bee products, fresh fruits and vegetables and dried fruits. Over the years, the demand for organic products has been growing steadily. For some products such as organic dried fruits, the demand by far exceeds supply. Products like organic Arabica coffee are increasingly being consumed in restaurants and coffee shops. Through a basket delivery scheme of one of the organic outlets (NOGAMU shop), fresh fruits and vegetables and other organic products (e.g. sesame, spices, teas, fruit concentrates) are supplied on an order basis to customers. Customers place their orders by telephone or email and baskets are prepared and delivered to their doorsteps.

The driving factor in the domestic market for organic products relate to the fast expansion of big retail chains. Targeting upper class consumers in urban areas –including foreigners and well-educated national citizens – they increasingly try to respond to consumers’ interest for best quality, including organic. As competition among different retail chains is increasing, specific retailers are more willing to get involved in the promotion of organic as part of their strategy to attract consumers and generate a favourable image compared to their main competitors. Since freshness is one major quality factor for consumers, especially for fresh vegetables and fruit, street markets may also become important promoters of organic food—especially if well-located, near upper-class consumers and are well-managed and ensure quality through hygiene and trustworthy sellers.

Brainstorming session: domestic markets for organic products from Africa

Engage the participants in a discussion about domestic markets for organic products. Let them elaborate and share ideas based on the following questions:

- Why is the domestic market still small in many African countries?

- What could be done to promote domestic markets?

Supply of organic products

Global data on organic production

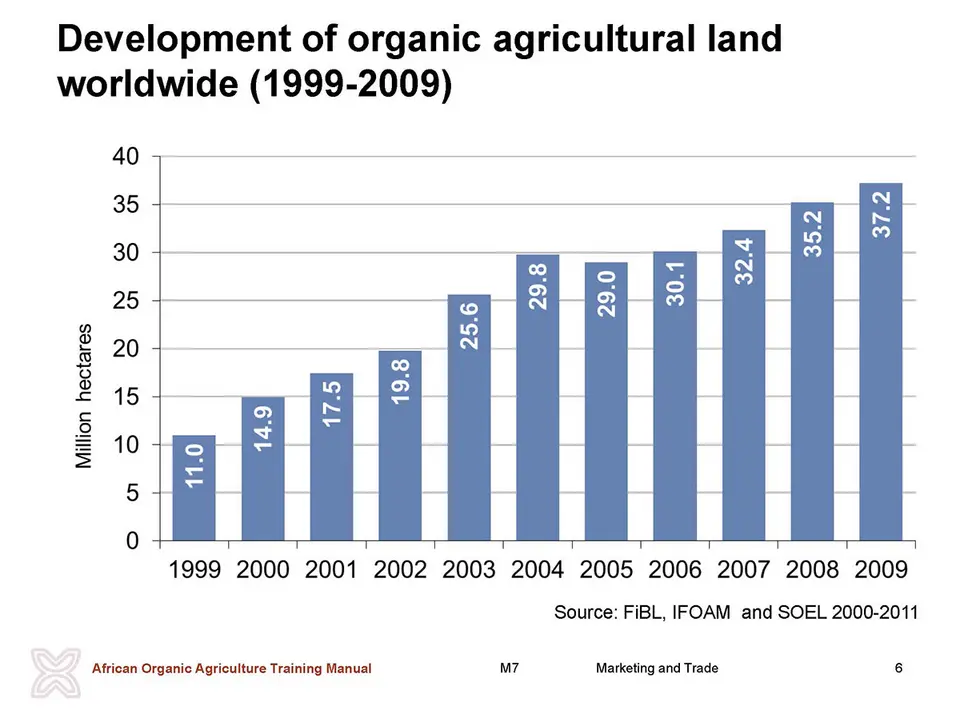

The main results of the latest global survey on certified organic farming (data from 2009) show that 37.2 million hectares of agricultural land are managed organically. Approximately 160 countries or areas/territories report organic farming activities. The regions with the largest areas of organically managed agricultural land are Oceania (12.2 million hectares), Europe (9.3 million hectares) and Latin America (8.6 million hectares). The countries with the most organic agricultural land are Australia, Argentina and the United States. Worldwide 0.9 percent of land is organic; the highest shares of organically managed agricultural land are in the Falkland Islands (35.7 percent), Liechtenstein (26.9 percent) and Austria (18.5 percent) (FiBL and IFOAM 2011). On a global level, the organic agricultural land area increased in all regions, in total by almost three million hectares, or nine percent, compared to the data from 2007. Since 1999, the organic agricultural land has more than trebled.

5 FiBL and IFOAM (2011): The World of Organic Agriculture 2011. Statistics and Emerging Trends. Edited by Helga Willer and Lukas Kilcher: International Federation of Organic Agriculture (IFOAM), Bonn, and Research Institute of Organic Agriculture (FiBL), Frick

More than one third of organic producers are in Africa

Almost two-thirds of the agricultural land under organic management is grassland (37.2 million hectares). With a total of at least 5.5 million hectares, arable land constitutes 15 percent of the organic agricultural land. Permanent crops account for approximately six percent of the organic agricultural land, amounting to 2.4 million hectares. The countries with the highest numbers of producers are India (677,300 producers), Uganda (187,900) and Mexico (128,900). More than one third of organic producers are in Africa. In addition to the agricultural land, there are 41.5 million hectares of organic wild collection areas and land for bee keeping. Further organic areas include aquaculture areas (0.43 million hectares), forest (0.06 million hectares) and grazed non-agricultural land (0.26 million hectares).

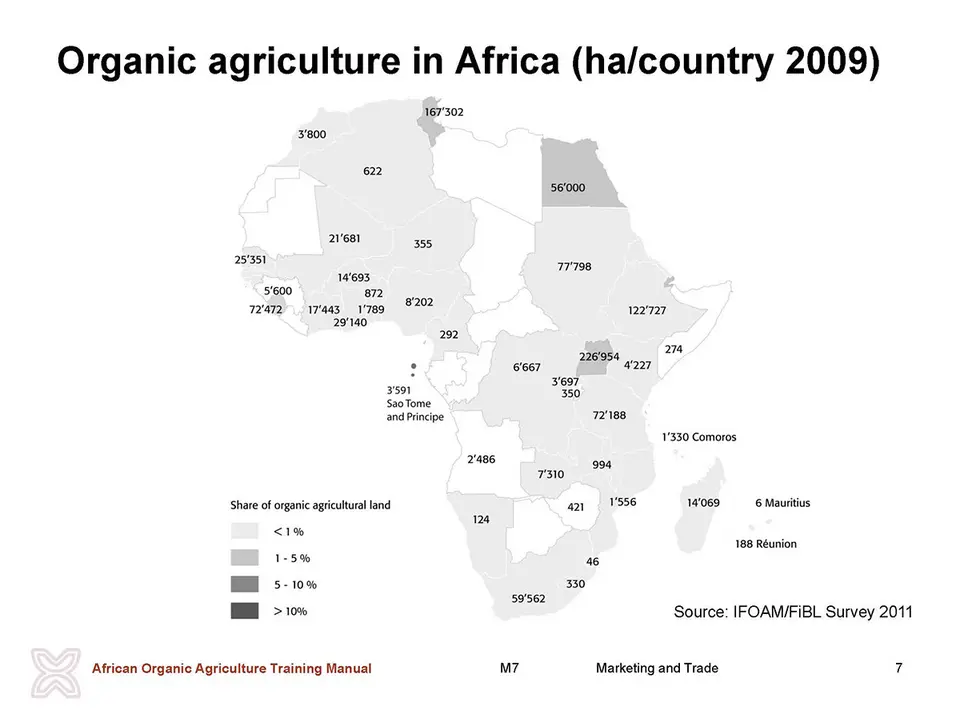

African organic production: More than 1 million hectares

Global demand on organic products represents a huge market opportunity for farmers in Africa, as they can gain access to higher value organic domestic and export markets and provide their families with a richer and more varied diet. Therefore, organic production developed considerably in Africa:

- In Africa in 2009, more than 1 million hectares of land is certified organic. Since 2000, the organic area has grown more than 15-fold.

- In global terms, Africa accounts for 3 percent of the world’s organic agricultural land.

- The countries with the most organic land are Uganda (226,954 hectares), Tunisia (167,302 hectares) and Ethiopia (122,727 hectares).

- The highest shares of organic land are in Sao Tome and Prince (6.5 percent), Sierra Leone (1.8 percent) and Uganda (1.7 percent).

- Substantial increases were recorded in countries like Sierra Leone (+71,512 hectares) and Ethiopia (+22,783 hectares).

- In 2009, there were 500,000 certified organic producers in Africa. Uganda (187,893 farms) has the largest number of organic farms, followed by Ethiopia (more than 100,000 farms) and Tanzania (85,366 farms).

- Organic farmers in Africa produce a diversity of organic crops. The range goes from cash crops like coffee, cocoa, tea, cotton, sesame and olives to processed fruits and vegetable oil, and includes everything in between (e.g. fresh fruits and vegetables or honey).

- In addition to the one million hectares of certified organic agricultural land, 16.4 million hectares of land are organic beekeeping, forest and wild collection areas.

Brainstorming session: Status of organic agriculture in Africa

Engage the participants in a brief discussion about the facts and figures given above. Let them elaborate and share ideas based on the following questions:

- Why is organic production growing worldwide, including Africa?

- Why are organic markets concentrated in Europe and North America?

- Why is organic production developing faster in some African countries like Uganda and not in others?

- What is the situation of organic production in your region?

Increasing consumer concerns make organic markets grow

Demand for organic products is growing in nearly all countries of the world due to growing awareness and improved availability for organic products. Consumers are increasingly buying organic for the following reasons:

- They want to buy guaranteed food which is produced without pesticides;

- They care for food that promotes sustainable agricultural production practices and especially biodiversity (e.g. promoting rare plant and animal species, diversity of plants and animals);

- They care about the well-being of animals;

- They want food whose origin they know and how its production benefits producers and the environment;

- They prefer products that contribute to the mitigation or the effects of climate change.

Most consumers expect multiple benefits from organic products – which vary among different consumer groups within and between countries. In any case, not all consumers are consistent in their perceptions and purchasing behaviour: they expect to buy high quality organic products, but not paying adequate price premium for these products.

Where to get information on markets, contacts and market potential?

The organic market information needs to be validated every year. Therefore, farmers, processors, traders, NGO’s and other stakeholders of the market chain need to know where to access relevant information for their context and how to interpret such information:

- Certification bodies - Certification is a marketing tool: its role in the organic value chain is to guarantee that the consumer gets organic quality where products are labelled as such. Certification bodies annually inspect and certify organic farm production, processing and trade at all levels of the food chain. They play an important role in building trust and guaranteeing product quality. In many cases, certifiers are also a reference for the interpretation of standards and are an important source of information in the start-up of a project.

- National Organic Agriculture Movement (NOAMs) - The National Organic Agriculture Movements are organic private sector organizations that represent the interest of the organic industry in a country. They also provide services such as advisory services, market information and market coordination, organization of farmers, farmers’ groups and multi-stakeholder groups. They provide addresses of individuals, institutions and authorities involved in the organic sector and can coach farmers in the conversion process towards organic farming. NOAMs are not equally represented in all African countries. In some countries, their role is fundamental offering many services to the organic sector (e.g. Uganda), in other countries they still do not exist (e.g. Tunisia).

- NGOs involved in local market developments are a good addressas well. NGOs can also assist in getting first information on domestic and export markets.

Websites

- www.africa-organic.net The Organic Farming Resource Directory consists of:

- Market-related resources (such as addresses of market actors, market-related information);

- Country regulations and statistics (such as crop and market statistics, standards and regulations, phytosanitary requirements);

- Link library with key information resources (such as markets and certification).

- Centre for the promotion of imports (CBI) www.cbi.eu

- Greentrade www.greentrade.net

- International Federation of Organic Agriculture Movements (IFOAM) www.ifoam.org

- ITC International Trade Center: Organic market place www.intracen.org/organics

- Organic link www.organic-market.info

- Organic Monitor www.organicmonitor.com

In any case, most relevant information for the local context actors may find when interacting with other actors involved in organic production and marketing. For sure, producers, traders, local service providers (NGOs and researchers) and retailers manage highly important information that goes beyond statistical information. Their contacts may not only provide relevant information, but serve as door openers to setting up real business relationsships.

Discussion: Access to organic market information

Collect, analyse and discuss the different sources of market data information available in your region. Which are the most accessible and valuable sources? How can access be improved?

tap and then scroll down to the Add to Home Screen command.

tap and then scroll down to the Add to Home Screen command.