How to promote organic market development?

Understanding the sector

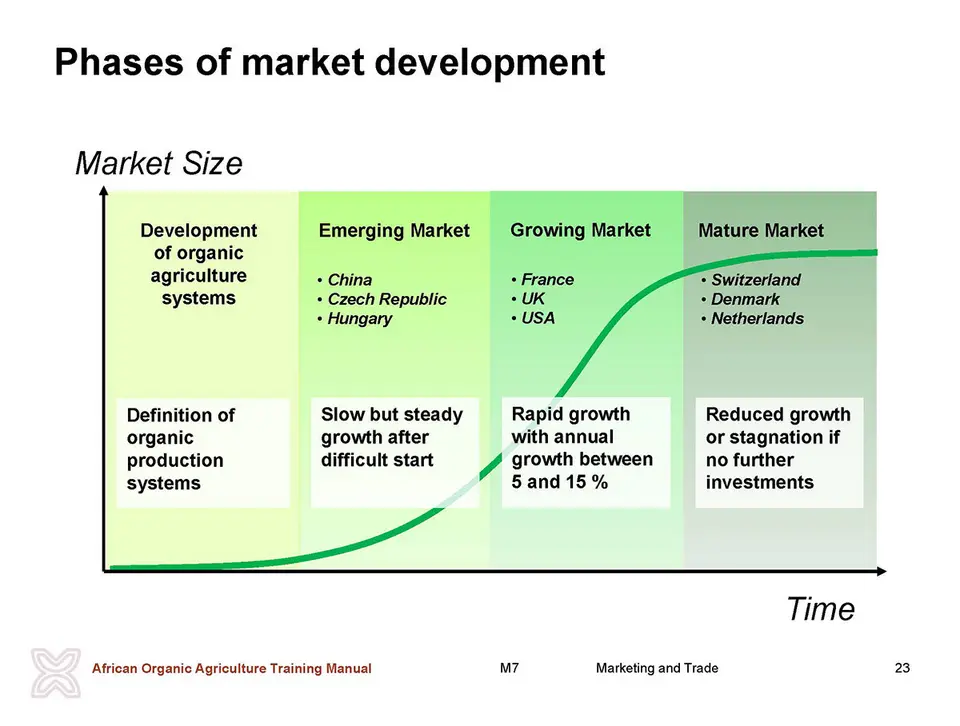

In order to successfully support organic market development, it is important to assess the existing situation in a specific region or country. This assessment will help to understand how the sector has evolved and what actors are key in driving the sector’s development. From a marketing point of view, this assessment will help to determine where the organic sector stands, as a first step to plan potential interventions. The fact is that interventions will need to be adapted to the situation of the sector, where three main stages can be differentiated:

- Emerging markets – young markets, with a limited market size for organic products

- Growing markets – markets with a fast growth rate for organic products

- Mature markets – markets with an important share of organic product sales but low growth rates

Interventions to promote organic sector development

The identification of the main driving activities and actors that have the strongest influence on the development of the sector will additionally provide relevant information on how stronger market development could be triggered. In this regard, two main ’strategy logics’ must be differentiated to be sensitive for the main factors that ‘drive’ the market development process:

- ‘Push-Strategy’ – when supply is primarily ‘pushed’ into the market

- ‘Pull-Strategy’ – when demand is primarily ‘pulled’ into the market

Organic markets develop such that in a first stage – in the phase of an emerging market – a ‘push-strategy’ drives the process, where active farmer organisations tend to find adequate retail solutions to be able to sell their organic produce in the market, many times directly to consumers. A ‘pull-strategy’ comes in at a later stage – in the phase of strong market growth, when retailers start to develop the market and ‘pull’ new products into their shelves. Market development interventions must respect the specific situation of the sector in this regard. We differentiate methodologies that respond to these settings:

a. Push-strategy approaches

Interventions aiming to push organic products into the market relate very much to the idea of helping farmers get better organised, especially in the area of marketing. The core principal lies in developing collective marketing structures and setting in place an enabling framework for organic production (e.g. extension related to organic agriculture, subsidies for organic production, etc.). Such types of interventions have the following objectives:

- To improve productive capacities of farmers;

- To improve the sales situation of farmers through better organisation and coordination of their supply;

- To boost added value of organic products and sales prices through storage, improved packaging, processing, direct selling and promotion.

The use of push-strategy approaches to boost organic market development is mostly motivated by the interest to increase rural incomes. The target of such an approach is to help farmers establish together with other market chain stakeholders effective ’organic market initiatives’ (OMIs) (see box below), which allow them develop improved organic marketing structures at the regional or national level. Directly and indirectly, farmers will benefit through such initiatives from improved market access, where they are in the forefront to take advantage of new possibilities for diversifying products and marketing activities. Such OMIs are common in most countries and critical in most African countries to develop a domestic market for organic products, being many times also essential to obtain sufficient organic supply for export.

The actors using push-strategy approaches are mostly local NGOs aiming to increase the incomes and the competitiveness of rural areas. Once organic sector institutions are in place, also these may use such approaches to strengthen their members, mainly consisting of farmers and local farmer organisations. In practice, the use of such approaches implies the setting in place of stakeholder meetings to discuss and agree on joint action, to buildup improved collective marketing structures. Most interventions in this domain are ad hoc, based on common sense.

What is an Organic Market Initiative (OMI)?

An OMI is an organisation of organic producers and other people in the organic food chain that ’share a common interest in producing, processing and marketing organic products.’ OMI’s help link the stakeholders in a value chain, from production to the consumer. Therefore, cooperation within the food chain such as between producers, traders, processors and retailers is essential. In many cases, successful OMIs are innovative businesses, initiated by producer groups starting with processing and marketing of their products to improve their market position. Sometimes participants of OMIs are also involved in diversified activities such as tourism or environmental protection.

The overall goal of an OMI is to contribute to the growth of the organic sectors and to integrate into the local and international trade by getting access to new market opportunities for small and medium farmers and other stakeholders of the organic value chain.

Once successfully started, an OMI needs continuous innovation:

- new products, services and promotion attract new customers

- new production or processing methods to improve production efficiency and lower costs

- new networks to access new sales points and enhance public awareness

b. Pull-strategy approaches

Pull strategy approaches are interesting and relevant in settings where the organic market is already established. In this case, such approaches would aim to capitalize the existing structures and boost growth through pulling in new products into a growing market. In practice, such approaches imply strong direct or indirect investments in consumer awareness, making consumers understand the benefits of organic versus conventional production.

Since consumer awareness campaigns are very costly, approaches that aim to target consumers directly with ’organic messages’ are mostly used in contexts where there is strong government commitment to boost organic agriculture. Sector bodies or the government itself may use such approaches involving their own staff doing the interventions.

Differences are seen with approaches that primarily target bigger retailers as key actors to promote organic through their own means, but also to invest in a more ’aggressive’ sourcing of organic products. In this latter case, a more neutral institution is needed to build sound partnerships between retailers and suppliers. The institution using such approaches will find itself rather in ’facilitation’ than in an ’implementation’ role, considering that actors themselves will be mainly implementing the needed activit ies (e.g. public awareness activities, development of new products, improved presentation of products). Two more clearly outlined approaches that merit to be mentioned to plan and implement market-oriented interventions are:

- Public Private Partnerships (PPPs) - PPPs aim to subsidize the development of a partnership between a strong company (in this case a retailer with interest to boost organic for own image and sales reasons) and other actors (in this case different organic farmers and providers). The approach foresees that the company involved makes important own investments as part of the agreement.

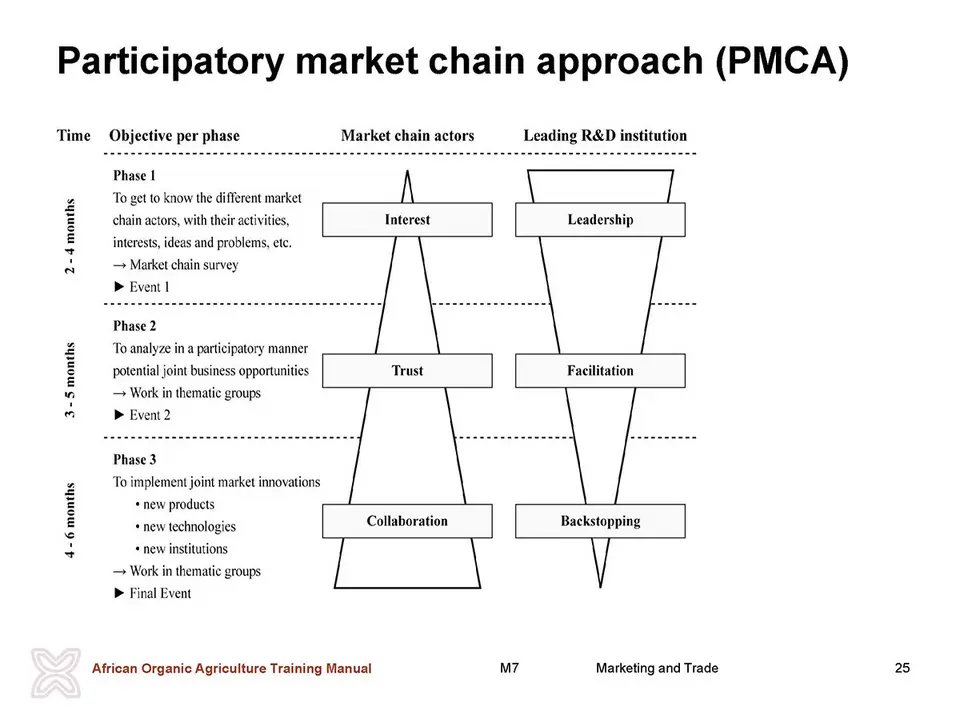

- Participatory Market Chain Approach (PMCA) - In contrast, PMCA is based on a much more participatory approach involving a much broader range of market chain actors. In this case, with a strong focus on consumer demand, the main aim is to set in place a series of relevant market opportunities driven by the interest of key actors in the sectors such as processors, traders and retailers. In this sense, PMCA is much broader and more flexible than a PPP, which is limited to a previously defined partnership, while PMCA aims to develop important social capital across the whole sector.

The Participatory Market Chain Approach (PMCA)

The Participatory Market Chain Approach (PMCA) encourages group innovation involving all the different actors involved in a specific market chain and sector. The innovations included are new products and processes, new technologies or new institutions that benefit the different people of the food chain directly or indirectly.

Methodologically, PMCA suggests a very pragmatic work implemented by a ’facilitation team’—a group of persons in charge of planning and leading a process that functionally involves sector stakeholders. The participatory process involved in PMCA relates to three phases (see figure) that help to structure the R&D process by gradually generating (a) interest (b) trust and (c) collaboration among involved market chain actors and other stakeholders present in the sector (i.e. NGOs, government entities, research and education centres). This same process structure aims to empower actors as it boosts ownership about the innovations that are jointly (a) defined (b) analyzed and (c) implemented. For further information on PMCA see:

PMCA Summary: http://www.cgiar-ilac.org/files/publications/briefs/ILAC_Brief21_PMCA.pdf

PMCA User Guide: http://www.cipotato.org/publications/pdf/003296.pdf

tap and then scroll down to the Add to Home Screen command.

tap and then scroll down to the Add to Home Screen command.